2016 BRICKPICKER LEGO RAFFLE

2017 BRICKPICKER LEGO RAFFLE

2018 BRICKPICKER LEGO RAFFLE

2019 BRICKPICKER LEGO RAFFLE

2020 BRICKPICKER LEGO RAFFLE

2021 BRICKPICKER LEGO SWEEPSTAKES

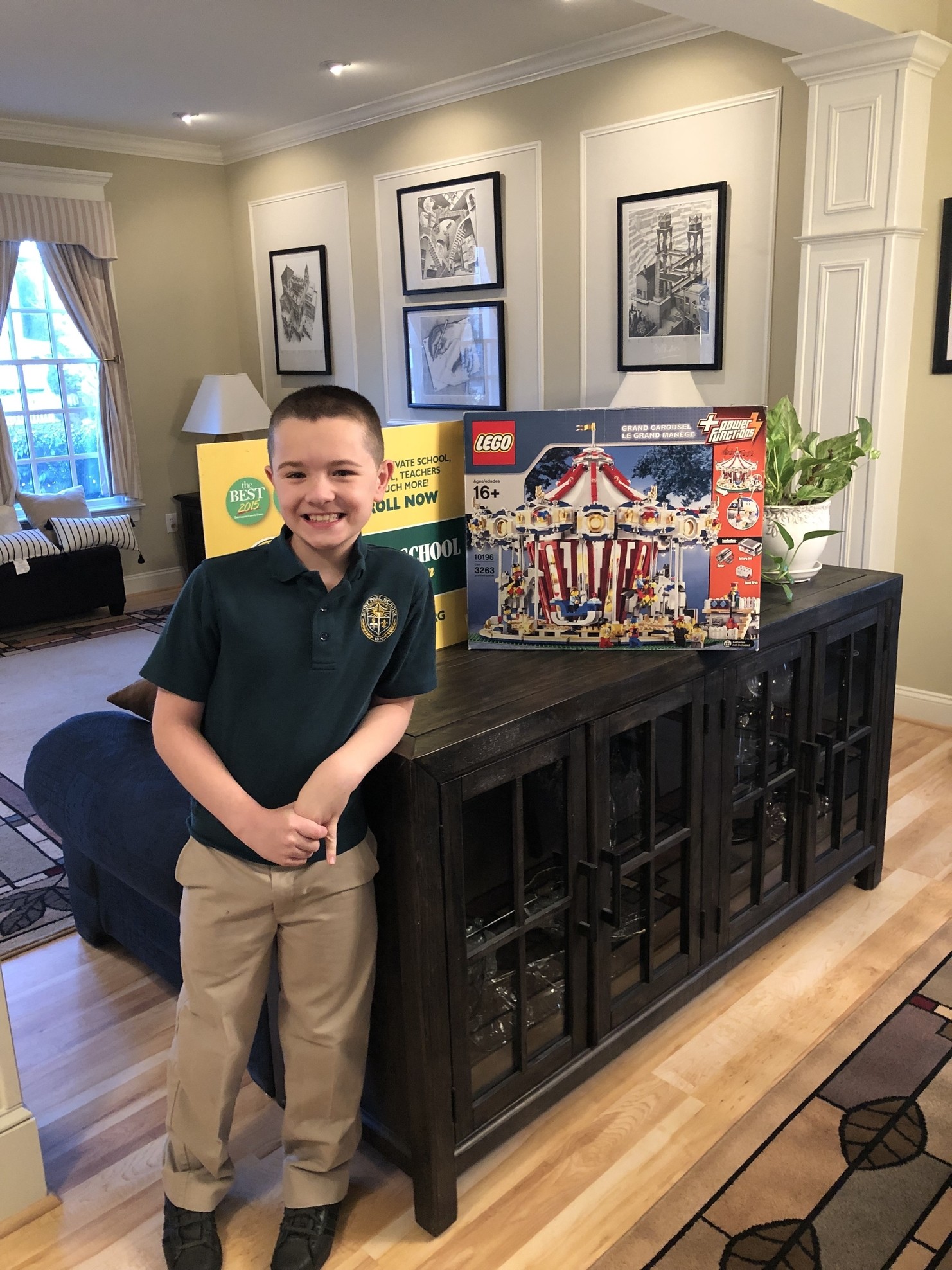

...have been extremely successful, and I am hoping for more generosity and kind souls to take part in this year's version. Over the past six years, we raised over $225,000.00 for the school, which goes directly to the school and helps pay teacher salaries, utility bills, etc. Another year has passed and it’s time to raffle off some more dynamic LEGO gifts and gift cards for charity. The money we raised the last six years literally kept the school open...which is a great thing. It's a special school that once again was voted BEST or ONE of the BEST Private Schools (7 years in a row) in Burlington County, NJ, by The Burlington County Times. Along with the whole school being voted either BEST or One of the Best, St. Paul School and its faculty also won numerous other awards, such as:

Best or One of the Best Private Schools

Best PreK-Nursery School

Best or One of the Best Teacher(s)

Best Fundraiser

Best or One of the Best Music Instruction

Best Tutor Service (National Junior Honor Society)

Best SAT/ACT Preparation Service

CLICK HERE TO GO TO THE 2022 BRICKPICKER LEGO SWEEPSTAKES FOR ST. PAUL SCHOOL!

As I stated (over and over again) the last six years, St. Paul School (SPS) and its community are special. My son loves the school, even though he won't admit it. Most days he actually runs into the school. People from all races and religions attend St. Paul School. Besides excelling in educating the children, the school does a tremendous amount of charity for local people in need. From food drives to helping out at local retirement homes, the children of St. Paul School are required to perform “service hours” that are designed to teach generosity, altruism and instill a hard-working, disciplined attitude. Excellence is expected and permeates through St. Paul School and the faculty and student body, so does a sense of goodness and frugalness. We make a little money go a long way. For example:

All grade levels (Pre – K through 4) are scheduled for “Specials” each week...such as art, music, library, computers, and physical education

St. Paul School is nationally accredited by “AdvancED” (the North Central Association Commission on Accreditation and School Improvement – NCA – CASI.)

SPS middle-school students have three periods of Spanish and are testing into Spanish II for High School.

SPS provides more periods of physical education each week than is required by the State.

SPS provides multiple extracurricular activities such as: LEGO Robotics Club, Science Club, Vocal Choir, Rosary Group, Tonal Chimes, Hand Bell Choir, Basketball (Boys/Girls), Soccer, Cheerleading, Yearbook Club, National Junior Honor Society (NJHS), Student Council, MATHCounts, STREAM (Science Technology Religion Engineering Art Math, Activity Tutorial Period (ATP for 5th-8th grades)

But all is not wonderful though. As many of you know, many Catholic schools have a hard time making ends meet. Enrollments are down and many families do not have the extra money to spend on a private education. Two neighboring Catholic schools in Willingboro and Maple Shade closed their doors last year. In person fundraising has been reduced drastically because of social distancing restrictions and reduced attendance in existing fundraisers. Even superb schools like St. Paul School have a hard time keeping the doors open, but unlike many public schools, St. Paul has been OPEN FULL TIME since last September. While it’s been difficult, the wonderful SPS faculty and staff has kept the kids safe and in a great learning and social environment. But it has been very difficult fundraising with social distancing protocols in place. Many traditional fundraisers have been shelved, so the Brickpicker LEGO Sweepstakes is even more important than previous years. While our enrollment has stabilized, we will still be way short of breaking even; thus the need for the 2022 BRICKPICKER LEGO SWEEPSTAKES. This year’s version of the LEGO raffle will start with SIXTEEN awesome prizes! These include:

PRIZE DETAILS:

1 Winner(s) will receive:

"WE ARE THE WORLD" LEGO LOT

31203 World Map (11695 Pieces!!!)

21332 IDEAS The Globe

11015 LEGO Classic: Around The World

1 Winner(s) will receive:

THE FAST AND FURIOUS FOUR WHEEL FRENZY!

42122 TECHNIC Jeep Wrangler

42123 TECHNIC McLaren Senna GTR

76903 Speed Champions Chevrolet C8.R Corvette & 1968 Chevrolet Corvette

42093 TECHNIC Chevrolet Corvette ZR1

76900 Speed Champions Koenigsegg Jesko

42111 TECHNIC Fast and the Furious Dom's Charger

76904 Speed Champions Mopar//Dodge SRT Top Fuel Dragster & 1970 Dodge Challenger T/A

76902 Speed Champions McLaren Elva

30343 Speed Champions McLaren Elva (polybag)

42134 TECHNIC Monster Jam Megalodon

42122 TECHNIC Jeep Wrangler

76901 Speed Champions Toyota GR Supra

31113 Creator Race Car Transporter

76900 Speed Champions Koenigsegg Jesko

1 Winner(s) will receive:

FRIENDS AND MORE FRIENDS...

21319 LEGO IDEAS (FRIENDS) "Central Perk"

10292 LEGO FRIENDS "The Apartments"

AND

41443 LEGO FRIENDS Olivia's Electric Car

41375 LEGO FRIENDS Heartlake City Amusement Pier

41431 LEGO FRIENDS Heartlake City Brick Box

41701 LEGO FRIENDS Street Food Market

41089 LEGO FRIENDS Little Foal

41707 LEGO FRIENDS Tree Planting Vehicle

41691 LEGO FRIENDS Doggy Day Care

1 Winner(s) will receive:

GREEN WITH ENVY! TECHNIC Lamborghini Sián FKP 37

1 Winner(s) will receive:

"The Wretched Hive of Scum and Villainy" STAR WARS LOT

LEGO 75290 STAR WARS Mos Eisley Cantina

LEGO 8092 Special Edition STAR WARS Luke's Landspeeder

LEGO 75205 Mos Eisley Cantina (retired)

1 Winner(s) will receive:

ST. PAUL MYSTERY LOT (#1)

LOT #1...Collected over the past six months by the St. Paul community...Dozens of LEGO sets that contain thousands and thousands of pieces. All types, themes and sizes possible. Jeff and I even threw some in for good measure. Guaranteed 7500 pieces...at least This prize kicks butt!

1 Winner(s) will receive:

OUT OF THIS WORLD...LEGO SPACE SET STOCKPILE!

92176 NASA Apollo Saturn V

10266 NASA Apollo 11 Lunar Lander

30365 Space Satellite

6079531 Classic Space Minifigure

60348 Lunar Roving Vehicle

60226 Mars Research Shuttle

60228 Deep Space Rocket and Launch Control

60229 Rocket Assembly and Transport

1 Winner(s) will receive:

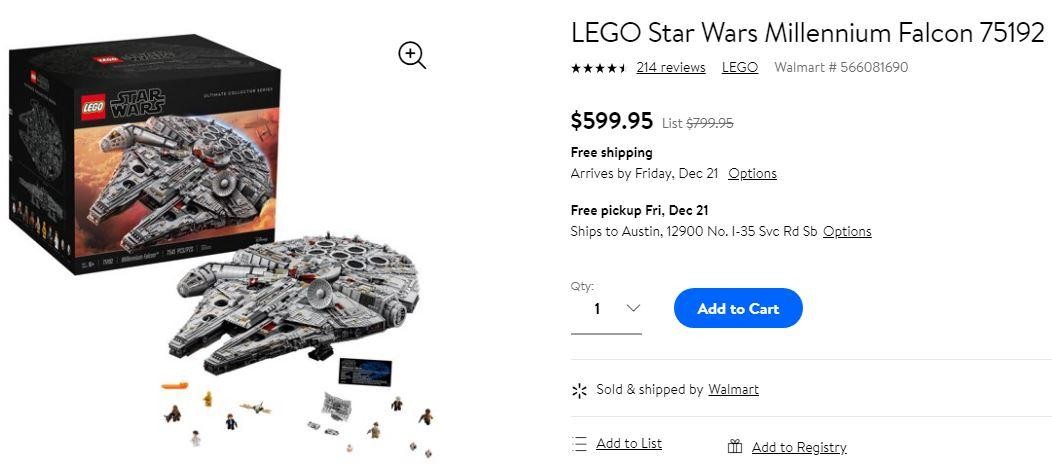

$500.00 IN GIFT CARDS! (GIFT CARD PRIZE #1)

$500.00 in gift cards of your choice! Choose from retailers such as...

Amazon

Walmart

Target

Apple

Disney

LEGO

...and many more! Choose from many major retailers!

1 Winner(s) will receive:

DC & MARVEL COMICS(CON) COLLECTION...

2008 Comic Con Batman and Joker Promotional Box Set (The Video Game)

31205 Jim Lee Batman Collection

76165 Iron Man Helmet

76126 Avenger's Ultimate Quinjet

76186 Black Panther Dragon Flier

76104 The Hulkbuster Smash Up

76179 Batman & Selina Kyle Motorcycle Pursuit

76154 Eternals: Deviant Ambush

76190 Iron Man: Iron Monger Mayhem

76124 War Machine Buster

77905 Comic Con Black Widow Taskmaster’s Ambush

76114 Spider-Man's Spider Crawl

76191 Infinity War: Infinity Gauntlet

76155 The Eternals: In Arishem's Shadow

76157 Wonder Woman vs. Cheetah

76140 Iron Man Mech

1 Winner(s) will receive:

IDYLLIC IDEAS LOT

21317 Steamboat Willie

40448 Vintage Car

40487 Sailboat Adventure

21319 Central Perk

21312 Women of NASA

21316 The Flintstones

92177 Ship in a Bottle

21326 Winnie the Pooh

1 Winner(s) will receive:

THE STAR WARS HELMET COLLECTION

75304 LEGO Darth Vader Helmet

75305 LEGO Scout Trooper Helmet

75277 LEGO Boba Fett Helmet

75276 LEGO Stormtrooper Helmet

75327 LEGO Luke Skywalker Red 5 Helmet

75328 LEGO The Mandalorian Helmet

75343 LEGO Dark Trooper Helmet

1 Winner(s) will receive:

HARRY POTTER HOGWARTS HOARD

31201 Harry Potter Hogwarts Crests

76392 Hogwarts Wizard's Chess

30628 The Monster Book of Monsters

75954 Hogwarts Great Hall

75969 Hogwarts Astronomy Tower

75953 Hogwarts Whomping Willow

40495 Harry, Hermione, Ron & Hagrid

40496 Voldemort, Nagini & Bellatrix

76385 Hogwarts Moment: Charms Class

1 Winner(s) will receive:

AMUSEMENT PARK MADNESS!

10247 Creator Expert Ferris Wheel (New/sealed bags and complete...Box has some wear.)

40346 LEGOLAND

70432 Hidden Side Haunted Fairground

31095 Creator Fairground Carousel

1 Winner(s) will receive:

THE ARCHITECTURE ASSEMBLAGE

21042 Statue of Liberty

21054 The White House

20029 Buckingham Palace

21045 Trafalgar Square

21044 Paris Skyline

21034 London Skyline

21028 New York City Skyline

21043 San Fransisco Skyline

1 Winner(s) will receive:

ST. PAUL SCHOOL MYSTERY LOT (#2)

LOT #2...Similar to LOT #1. Collected over the past six months by the St. Paul community...Dozens of LEGO sets that contain thousands and thousands of pieces. All types, themes and sizes possible. Jeff and I even threw some in for good measure. Guaranteed 7500 pieces...at least This prize also kicks butt!

1 Winner(s) will receive:

$500.00 IN GIFT CARDS! (GIFT CARD PRIZE #2)

$500.00 in gift cards of your choice! Choose from retailers such as...

Amazon

Walmart

Target

Apple

Disney

LEGO

...and many more! Choose from many major retailers!

Once again, this year’s total prize value equals or exceeds the previous six year's annual prize value. The last six years, we had 66 raffle/sweepstakes prizes and winners from around the world. From Vancouver, Canada to Reno, Nevada to Miami Beach, Florida to the Isle of Man, United Kingdom and everywhere in between, generous raffle participants were rewarded with awesome LEGO prizes. We even had repeat winners! This year we are starting with 16 prizes, but I always add more along the way. The 2022 BRICKPICKER LEGO SWEEPSTAKES can be found here on the secure Rally.up.com site:

CLICK HERE TO GO TO THE 2022 BRICKPICKER LEGO SWEEPSTAKES FOR ST. PAUL SCHOOL!

Like the last six years, we will ship most of the prizes to anywhere across the globe. Two of the large lot prizes (SPS Mystery LOTS #1 and #2) are so large I can only ship them to United States customers who live in the contiguous 48 states due to shipping costs. If there is an issue with shipping or prizes, a comparable prize and/or shipping method will be arranged with the winner. The last six years, the LEGO BRICKPICKER raffles and sweepstakes worked very well. The Rallyup.com site is a first class, secure site that made this all possible. They also issued the school a big fat check(s). All raffle proceeds and donations benefit the school directly by bridging the gap between what tuition covers and actual educational costs. It also raises money to upgrade the school’s technology, keeping St. Paul School ahead of the academic curve with a dynamic curriculum. The prizes have been donated by Jeff and I, the St. Paul School PTA and by some very generous BrickPicker members. I am hoping, like last year, that more people will donate sets after the sweepstakes begins. It was fun adding to the prizes last year. You never know what can pop up as a prize! I AM ALWAYS ADDING NEW SETS!!!

On a personal note, once again, I would like to thank every person who donated sets/money and/or bought tickets to last six LEGO BRICKPICKER raffles and sweepstakes. It helped save a wonderful school and kept dozens of people employed and 180 kids with their friends and teachers. I don’t like asking but will anyway...please help out again this year. Even buying one ticket can help, and it gives you a chance to win some great prizes. Watching the raffle ticket total rise every day was an intense rush and extremely gratifying experience. It made me so proud to have started this site with my brother Jeff and made me realize there is still good in this world. I know some people do not approve of donating to faith- based schools or charities. I respect that, but also please respect my beliefs. This is not about religion. This is about helping a great school remain open and kids in their school and teachers in their jobs. Please keep negative comments to yourself. Thank you...

***The structure of last year's and this year's "sweepstakes" is similar to previous years' raffles, with the exception that a person cannot buy entries/tickets/donations for a specific prize. Due to changes in New Jersey online gaming laws in late 2020, online raffles are no longer allowed. It would appear that online scammers and thieves were using the pandemic as a way to run fraudulent raffles; thus, honest, charitable causes have been hurt. Rallyup.com has developed the "sweepstakes" system to replace the raffle in states that do not allow such online gaming. People can buy entries/tickets to win the prizes. One entry/ticket can win any prize. People can win multiple prizes. There are multiple entry/ticket price/amount combinations. Last year, we enabled winners to swap prizes with one another or exchange for gift cards. We will try to offer similar options this year as well. The more entries/tickets you buy, the cheaper the entries/tickets. The more entries/tickets that you have, the better chance you have to win. The entry/ticket fees/donations will go directly to St. Paul School. A free mail-in option is also available with the sweepstakes system, but remember, this is for charity. The Brickpicker LEGO Sweepstakes will stop selling tickets 3 days earlier than the drawing to allow for mail-ins to reach Rallyup.com. Remember, the school will receive ZERO donations if you choose the mail-in method.

***Rallyup.com will automatically and randomly pick and contact winners. Winners should then reach out to Ed Mack on www.BrickPicker.com to arrange for prize shipment. As with the previous six BrickPicker LEGO Raffles/Sweepstakes, prizes will be only shipped to a deliverable and legitimate mailing address. Every effort will be made to get the prizes to the winners...no matter where they are on the planet. In case safe and reasonable shipment is not possible, suitable prize arrangements/replacements will be made. The prizes with large lots of sets (St. Paul Mystery Lot) will only be shipped to the contiguous 48 states of the United States due to the excessive size and shipping costs. Alternate entry winners must pick up their prizes in person or pay for shipping and handling costs. Replacement sets/gift cards might have to replace some prizes in case of out of country (USA) winners or other issues arise. Winners have seven days from drawing date and time (May 5, 2022 9:00PM Eastern) to notify Brickpicker admin (Ed Mack) with proper ID and verified shipping address or the prizes will forfeited and donated to a future LEGO sweepstakes for St. Paul School. Alternate entry winners have seven days from the drawing date to pick up the prizes from sponsor (Brickpicker.com) and/or pay and arrange for shipping and handing fees (Minimum fee will be $100.00. Final shipping and handling fees will be determined after address of winner(s) are determined). Thank you.

LEGO SWEEPSTAKES START DATE: MARCH 15, 2022

LEGO SWEEPSTAKES END DATE: MAY 2, 2022 at 11:59 PM

LEGO SWEEPSTAKES WINNERS PICKED/NOTIFIED: MAY 5, 2021 at 9:00PM

(DUE TO NEWLY IMPLEMENTED NATIONAL/NJ REGULATIONS, THE DRAWING HAS TO BE 3 DAYS AFTER THE FINAL TICKETS ARE SOLD TO ALLOW MAIL-IN VOUCHERS TO ARRIVE. SORRY FOR THE CHANGE)

Thanks again!

Ed Mack

- Read more...

- 103 comments

- 38,481 views