[box type="info" ]This blog follows on from my previous blogs (May, July, September, and October) presenting the top 20 sets in terms of secondary market price growth according to the data we have available here on Brickpicker.[/box] Again, here are some notes on the scope before I begin:

- I have not restricted the qualifying sets by size or age or any other dimension

- Information is based on US prices only

- Not all sets across all themes are included as I have zero interest in Bionicle/Hero Factory for example so have only gathered data on a few of those sets. (I just didn’t have the willpower to gather all the data for them really). Most of the rest are covered though.

- I tried to look at as many sets as possible, but there is a chance a few may have been missed, if you spot some that should/could be included please let me know

- The Last Rank column indicates changes in ranking from the last Top 20 Blog (Oct data)

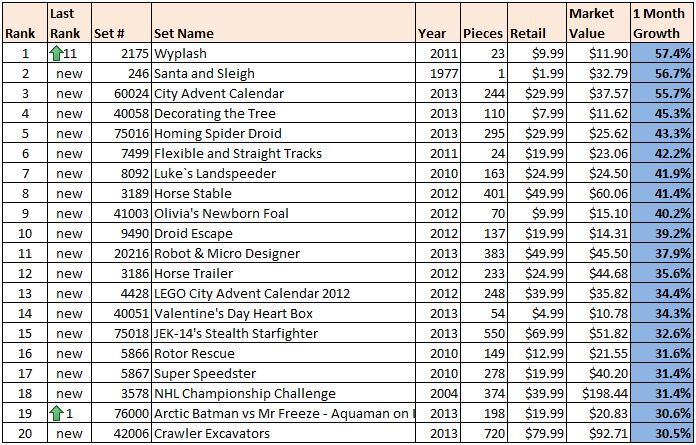

One Month Growth (change in Market Price from last month)

Almost a completely clean slate again, made up of entirely new entrants and that’s not really a surprise given volatility in prices when only looking at a change from 1 month to the next. 2175 Wyplash stays on the list jumping up 11 places to take top spot. The recently retired Ninjago set is doing quite nicely. 76000 Arctic Batman also manages to cling to a position on the monthly list. It will be interesting to see if any of these sets can maintain some of this growth longer term. Which leads us nicely onto our next time period: Six Month Growth (change in Market Price from May 2013 )

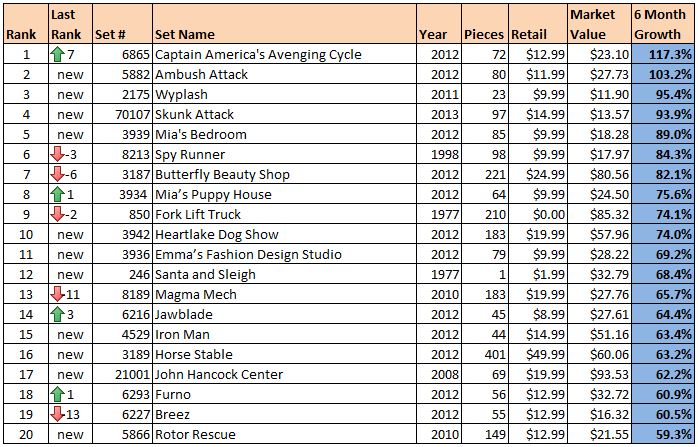

3187 Butterfly Beauty Shop gets bumped from the top spot of the 6 month returns list tumbling 6 places thanks to a return of -14% in the last month as no doubt investors look to take profits. 6865 Captain America Cycle jumps to top spot with continued excellent price growth since its retirement mid 2013. Will it continue that run? Lots of new entrants again, some with pretty low volumes, though others are there that really deserve their position. 2175 Wyplash comes in at number 3 thanks to taking that top spot for monthly growth in the section above. 5882, 70107, and 3939 all new entrants straight into the top 5 on the back of solid demand. A couple of other wave 1 Friends sets, 4529 Iron Man, and 21001 John Hancock Center are also notable new entrants to the top 20 6 monthly growth list. One Year Growth (change in MarketPrice from November 2012)

6808 Galaxy Trekkor still at the top but can be discounted due to extremely low volumes, though there are plenty of others that command respect. The well publicized 9465 Zombies regains a little ground after recent slips. 4529 Iron Man takes a big leap up 10 spots to number 3. A few of the sets on the list look like they were 2012 releases that have now been around for a year and make the time criteria and have experienced that post EOL jump. Plenty of other great sets on this list that you’d have done well to buy at market price one year ago. Two Year Growth (change in Market Price from November 2011)

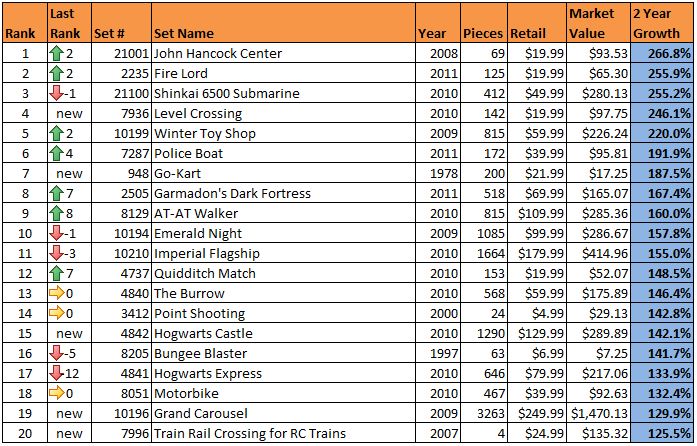

Now into the two year time frame we begin to remove some of the short term fluctuations that can occur with some of the narrower time periods. 21001 John Hancock Center gained another 15% in the month and that was good enough to push it back into top spot (was there in Sep as well). Boy I’d love to turn the clock back 2 years and grab a few of those for a 266% ROI ! 7936 Level Crossing is also an interesting set. It was number one on this list back in May & July. It then hit a flat spot, dropping to number 19 in September and off the list in October, but it’s now back in at number 4 thanks to another spurt of growth. Maybe people are expanding their train set layouts for Xmas? Retail Growth (change in Market Price from Retail MSRP)

Now for the full measure of growth from the retail value of the set. Obviously a set with a $0 listed retail price like all the promo giveaways etc are excluded as we can’t divide by zero, so that has weeded out a few of the small polybags or very very old sets for which we have no retail data. But the list is still dominated by cheap sets that have increased by large multiples. The 1626 Angel takes top spot with a crazy 20,477% growth over retail thanks to 1 recent sale of $250 and another 2 years ago of $280 all from a set that cost $1.30 when released back in 1989. 246 Santa and Sleigh make a return for the festive season. This old school set from 1977 had over 30 sales in the month at a value far higher than the original $1.99 MSRP (though we probably should adjust for 35 years of inflation!) Perhaps the first “real” contender is 10190 Market Street, such an impressive result for a set in just 6 years. Much better than another set from the same year that people often point to as the pinnacle of Lego investing… Conclusions These top 20 tables lists all the absolute best investment decisions you could have made if you had perfect future knowledge. The amount of under the radar sets and “sleeper” hits have been a big wake up call for me. We sometimes become a little circular in discussing the popular sets for investing (Modulars, UCS, etc) and lose sight of the fact that many of the best investments to be had right now are probably some of the least discussed sets. It does mean there are plenty more topics ripe for discussion on the forums and in blogs. It will be interesting when the December data is released to see if set have maintained some of their ‘form’. Plus the Xmas effect which is probably already present in some of the November data should come into full swing. This can be both a positive and a negative for set values as FcB demonstrated in a couple of blog posts. I’ve only given a cursory analysis of the lists themselves and would like to leave it to you on how best to interpret the results. The numbers should speak for themselves and I’d like to hear your take on them in the comments below.

Recommended Comments

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.