The talk of a Lego "bubble" has been discussed ad nauseum on this site, yet there is a side I thought about yesterday that hasn't been touched on yet. With thirty one themes (per Lego S@H list), TLG's product line is monstrous so it's plausible to foresee a certain segment of the Lego product line undergo significant devaluation sometime in the not-so-distant future.

To figure out if any sectors are at risk, let's define what a bubble is first. The classic definition of an economic bubble condition is when a product sells for significantly more than its intrinsic value. While this bubble definition is extremely broad, it gives us one nugget to consider: the concept of intrinsic value. Finding a lego brick's intrinsic value is actually quite simple and easily measured: figure out what people pay for a commoditized version of the product. For Lego bricks, Bricklink is a great resource for MOCers to purchase any number of thousands of bricks at competitive prices. These prices should set the basis to measure the intrinsic value of the set. To do this, we add up the price for each piece a set comes with, throw in the instructions, and throw in the box value, and voila - your replacement cost of materials becomes your measure of Intrinsic value". While this doesn't include the value of the time to purchase the pieces, or any number of other hidden costs. we can still use the cost of materials as a proxy for "intrinsic value".

Now that we have a rpugh approximation of the intrinsic value of a set, it can be compared to an average sold price for the set to see if there's a significant discrepancy between the two. In a bubble condition affecting all Lego products, we would expect to see a huge disparity in value between the part-out price and the BP new set value across a majority of themes and models. Alas, when making this comparison for random sets, we see there are literally thousands of sets where the sum of the parts is greater than the value of the model, both retired and unretired. Here are some examples I selected prior to knowing the part out and BP new set values:

Set Name - Part-Out Value - BP New Set Value

Portal of Atlantis - $130.78 - $65.61

Cafe Corner - $874.70 - $978.60

Green Grocer - $642.66 - $674.04

An Unexpected Gathering - $134.77 - $48.44

As I said, there thousands more, so based upon this analysis we can assume that there's no bubble Lego-wide at this point in time. Yet, there is one specific segment of the Lego product line where determining intrinsic value is extremely difficult: minifigures. Assessing the intrinsic value of a minifigure based on the sum of the part values doesn't make sense since the relatively small number of parts renders this analysis meaningless.

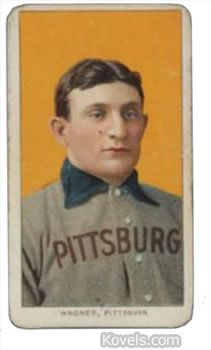

When delving deeper into the value of minifigures, it would stand to reason that a fig's value is based upon some combination of desirability and scarcity. Because minifigures are typically collected rather than "consumed" like the majority of Lego sets, it's easy to draw a parallel between minifigure collecting and baseball/beanie baby collecting. Typically, minifigures are worth what collectors will pay to add them to their collections similar to Joe Schmoe who buys a Honus Wagner tobacco card, or Peanut the Royal Blue Elephant. While army MOCers that require a large number of figs to complete their MOC provide an exception to the rule, most minifigs purchased separately are bought as collectibles. After seeing some incredible prices collectors are paying for ComicCon exclusive figures and the elusive Mr. Gold, it appears there's a real possibility of a minifigure bubble.

Honus Wagner - proof that collectible values are based more on scarcity than desirability...

How do we determine if there is a threat of a minifigure bubble? Let's take a look at the values of a cross section of specific minifigures:

Exclusives:

Bizarro (ComicCon 2012) - $237.50

Mr. Gold - $676.51

Non-Exclusives:

CMF Series 1: Zombie - $19.30

CMF Series 1: Forestman - $1.30

Black Falcon - Black Legs with Red Hips, Black Chin-Guard: $6.67

Farmer - Green Overalls, Blue Cap - $2.35

Kai, Kimono - $5.56

Voldemort, White Head - $4.83

This list highlights a significant characteristic of the Lego minifigure market: while Exclusive minifigures typically sport the "insane" values, non-exclusives have a much harder time posting crazy profits that are multiple factors above the value of an average minifig. This actually mirrors the baseball card market - "commons" don't have much value above the average card price, while exclusives, or in this case rare vintage cards, have tremendous value. The baseball card market has already gone through a bubble cycle, and today its characteristics loosely match the minifigure market. In fact, most collectible markets have this same structure - commons sell for a small, "average" price equivalent to the "intrinsic value", while exclusive pieces sell for significantly more. It's only when the value of exclusive figs begin to raise the prices of the commons that a true bubble condition occurs. For Lego minifigs, I don't see this happening anytime soon.

If demand suddenly craters for Lego products, you will see the entire secondary market suffer (including minifigs and retired sets), yet this would take an unprecedented shock to the system. More likely, a gradual erosion of popularity would occur over time if Lego stopped making sets that are desirable to their core children market. A final look at the baseball card market shows their "exclusives" are as popular as ever: on April 6 of this year, a Honus Wagner T206 sold for $2.1 Million, an unprecedented sum for this card. I would expect Lego minifigs to follow suit.

Recommended Comments

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.